Moving to the US: Credit Score

This is intended to be the first article of a series dedicated to moving to the US.

Are you planning on moving to USA? Have you already moved? Are you working on a visa? Then you will very likely find the information below very useful.

Back in 2014 I moved to the United States, to the lovely city of Portland. I knew nothing about how investments, saving accounts, health coverage, credit cards or even loans and mortgages worked here. Every city is different (more about housing in the next episode,) but the impact of the score happens everywhere.

One of the most important concepts is the (in)famous Credit Score. Yes, even for immigrants and non-immigrants (meh CBP definitions) workers.

In order to be able to work legally in the US as an ex-patriate or foreigner, you will need an Employment Authorization Document (EAD) to get your Social Security Number (SSN) which is basically a way for the government to track everything you do economically. I find the concept of SSN very interesting and would love if more countries applied the same logic. Note SSN is personal, not per business, and each person can only have one in their lifetime. It basically represents you and you’re never supposed to forget or lose it, for obvious reasons. And of course, getting these is the first chore you need to do as you arrive to the States.

What is the Credit Score?

Credit Score is a number between 350 and 850, assigned to your person (via SSN) that basically exposes how risky/trustworthy you are in the US economic system.

All banks and similar entities report to bureaus (these are Equifax, Transunion and Experian) that keep track of your credit score. The number itself, may slightly vary depending on the bureau (and what information they received.) The most common score is named FICO (standing for its creator) and it’s tracked by all bureaus.

TL;DR: Whenever you ask for money, the number will go down, and whenever you pay back, the number should go up.

How does it work?

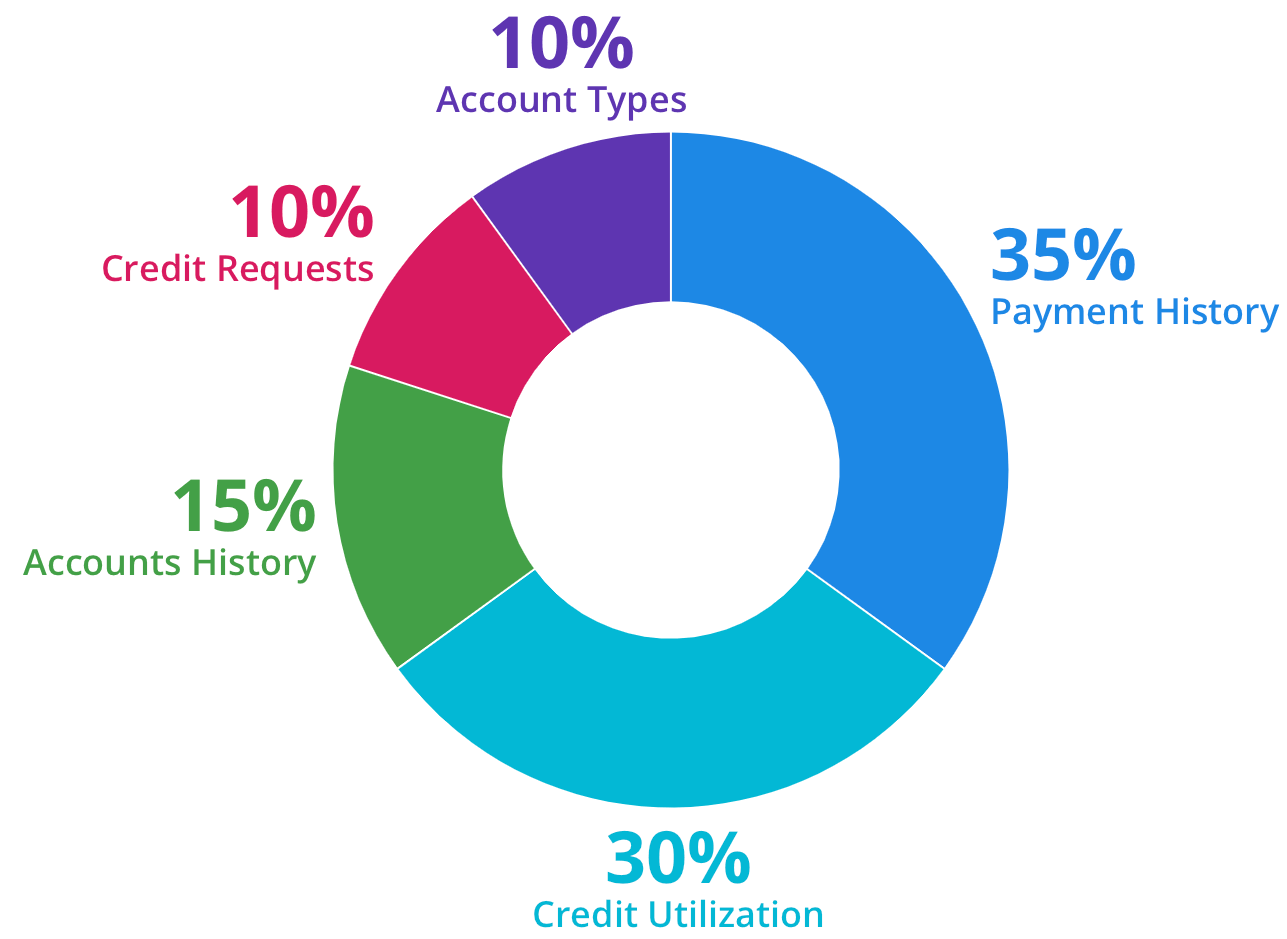

Your credit score will be composed by several factors, each having different weight on the final score, as follows:

- 35% Paying History means paying on time, always. At least the minimum.

- 30% Credit Utilization refers to the amount you use from the amount you’re allowed. A $500 statement on a $1,000 credit-limit card is using 50%. Ideally, you only use 10% of your limit (more on this below)

- 15% Average account history length, self explanatory and not a category we foreigners can really improve in the short-term.

- 10% Total credit pull requests or inquiries. There are two types: soft (when they check without asking for specifics a.k.a. pre-qualifying) and hard (impacts your score, generally the case when you’re applying to something new such as a credit card)

- 10% Diversification of accounts / Variety of type of accounts i.e., credit cards, car loans, student loans, mortgage, etc.

There are other factors composing the score in a not so linear way, for example:

- Number of total accounts (the more, the better)

- Remarks such as bankruptcy or unpaid balances for more than 2 months (ugh, you get penalized and lasts for up to 10 years.)

The Score can be split in the following ranges: 350-579: YOU SUCK or well, you have fucked it up. 580-699: Okay either you’re a newbie or you’re coming back from the dark side. There are actually subranges in here, 580-619, 620-659 and 660-699 but I consider there’s almost no difference between those. You should aim for 700+ 700-759: You can get any card you want and some of the best loan rates. 760-850: You are a credit score Jedi and will get the best mortgage/auto rate ever.

Beginner tips / First steps

As with everything, be patient and try to inform yourself before deciding.

- Become an authorized user (AU) on a friend’s card If you know anyone in the US with a credit card already, ask them to add you as an authorized user to their card. Why would someone trust you? Of course, don’t ask a stranger, but that co-worker you have a good relationship with, may be interested. Usually credit cards give points based on spend, meaning they would be earning money by having you spend on their account. But also, sometimes they can even get money by just adding you as an AU. This is the easiest way to get your first card that counts towards your credit score.

- Get a secured charge card Okay, you don’t have someone to trust or you’re too shy or irresponsible with money (yuck!) – There are two types of cards: charge (pay in full each month) and credit (allow you to carry a balance) Most banks offer secured charge cards, with a credit line of whatever amount you want to deposit. You give $500 to the bank, and they give you a card with a $500 credit line that you can re-use as long as you pay. This is easier to get than a credit card, given they don’t usually care about your score.

- Your first credit cards should all be no-fee You now have a score that allows you to get your first card. Don’t go and try to apply to that card that gives you free hotel nights and it’s a $450 annual fee. If you’re reading this, it’s likely it’s going to be one of your first cards, so get one without annual fee, so whenever you don’t want to use it anymore, you just keep it open to help your average history length without having to pay anything.

-

Always pay before statement closes Credit card limits work in a weird way. In Argentina, we are used to getting the statement after it closes, and then paying it before it’s due. Don’t do this.

If you wait to pay your card until the statement closes, that posts to your score as utilization, even if you pay it in full before it’s due. I cannot stress this enough. Remember, it’s 30% of your score.

Example: if you have a $1000 credit card limit, and you’ve spent $900 when the statement closes, you’ll be using 90% of your credit-line which is awfully bad for your score. If you pay, $800 out of those $900 the day before statement closed, you’ll be then using only 10% of your line (good for the score) even though technically you used more. Get the point?

- Never carry a balance Well, unless you get a 0% APR, and in that case don’t forget to pay the minimum each month always, and plan ahead to when you can cancel out the debt. Carrying a balance implies paying interest, and then you’re losing money and whatever benefit the card had for spend, will be less than the interest you’re paying.

- Don’t worry about average history length Of course! You have just moved to the US, your history length will be close to none, especially as you’re getting more cards to improve your score. This is not one of the most important factors, so don’t stress about it because you weren’t born here and don’t have a 20-years old savings account opened.

What next?

I highly recommend signing up for Credit Karma to keep track of your score and monitor your accounts (for example, to prevent fraud.) It is free and they also write good blog articles about all these topics. You can register as soon as you have your own SSN, but the score will only appear starting 3 months after you’ve received your first Credit Card statement. Ask for Credit Limit Increases to your bank every 3 to 6 months as long as they’re soft pulls (meaning they won’t have impact on your score.) For Citi you can do this via the mobile application, for American Express and Capital One you can do it online. Other banks such as Chase or Discover do it every 6 to 12 months after you update your salary in their systems, or via phone.

Other articles in this series

- How to rent in NYC (or anywhere)

- 401k and savings accounts (coming soon)

- Health/Dental/Vision/Pet coverage / insurance (coming soon)